Quicken Overview

Quicken is a financial management software designed to help individuals and businesses organize, track, and manage their finances. It provides a range of features that allow users to keep tabs on their income, expenses, investments, and other financial activities.

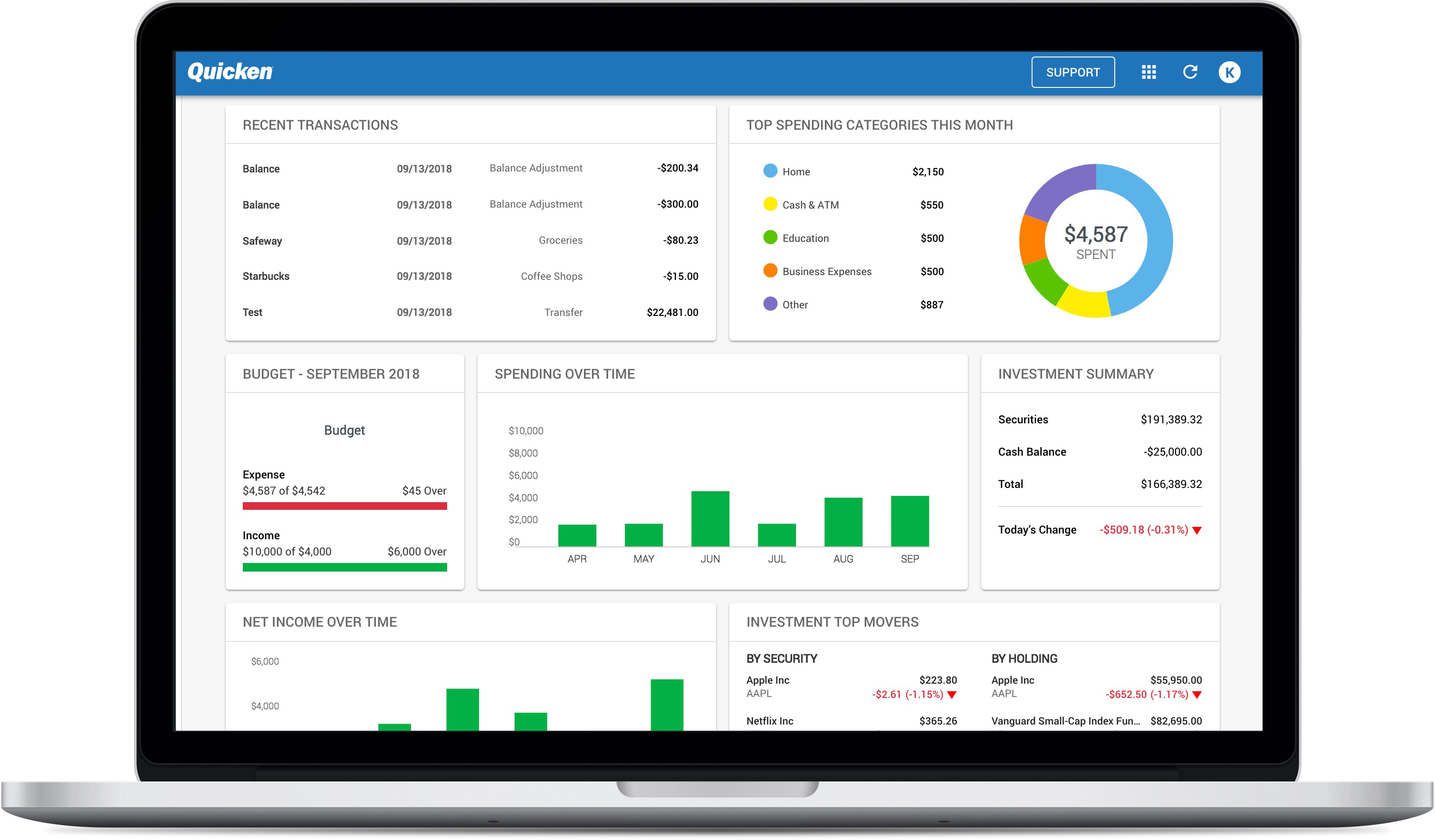

- Expense Tracking: Quicken allows users to categorize and track their expenses, making it easy to see where their money is going. This can help with budgeting and identifying areas where spending can be optimized.

- Income Management: Users can record and monitor their various sources of income, whether it be salaries, investments, or other forms of revenue.

- Budgeting: Quicken enables users to create budgets based on their income and expenses. It provides tools to help users stay on track and make adjustments as needed.

- Investment Tracking: The software allows users to monitor their investments, including stocks, bonds, and mutual funds. It provides tools for analyzing performance and assessing potential investment strategies.

- Bill Management: Quicken helps users stay on top of their bills by providing reminders and tracking due dates. It can also assist in managing recurring payments.

- Reports and Analysis: Users can generate a variety of financial reports to gain insights into their financial health. These reports can include income vs. expenses, net worth, and investment performance.

- Security and Privacy: Quicken typically employs robust security measures to protect users’ financial data.

Quicken Products

- Quicken Starter: This is the basic version of Quicken and is suitable for individuals or households who want to track their spending, create budgets, and manage their bills.

- Quicken Deluxe: This version includes all the features of Quicken Starter, with additional tools for optimizing investments, managing debt, and planning for retirement.

- Quicken Home & Business: This version is tailored for small businesses or self-employed individuals. It includes features for tracking business income and expenses, creating invoices, and generating profit and loss reports.

- Quicken Mobile App: This is a companion app that allows users to access their financial information on the go. It provides basic functionalities for tracking expenses and viewing account balances.

Quicken Customer Services

- Customer Support: Quicken offers customer support through various channels, including phone, email, and chat. Users can reach out to Quicken ‘s support team for assistance with technical issues, account management, and general inquiries.

- Online Community and Forums: Quicken maintains an online community and forums where users can interact with each other, ask questions, and share tips and advice related to using the software.

- Video Tutorials and Webinars: Quicken offers video tutorials and webinars that provide step-by-step instructions on how to use different aspects of the software. These resources can be particularly helpful for new users or those looking to learn more advanced features.

- Product Documentation: Users can access detailed product documentation, including user guides and manuals, to get a deeper understanding of how to effectively use Quicken .

- Software Updates and Downloads: Quicken provides regular updates to their software, which may include bug fixes, feature enhancements, and security improvements. Users can download these updates to ensure they are using the latest version of the software.

- Quicken Community Blog: Quicken maintains a blog that covers various topics related to personal finance, budgeting, and using the software effectively. It can be a valuable resource for users looking for financial tips and insights.

Quicken Benefits, Features And Advantages

Benefits:

- Comprehensive Financial Management: Quicken provides a holistic approach to financial management, allowing users to track income, expenses, investments, loans, and more, all in one place.

- Streamlined Budgeting: Users can create and customize budgets to better understand and control their spending habits. This helps in achieving financial goals and avoiding overspending.

- Efficient Expense Tracking: Quicken categorizes and organizes expenses, making it easy to see where money is going. This provides a clear picture of financial habits and areas where adjustments can be made.

- Investment Management: Quicken offers tools for monitoring and analyzing investments, aiding users in making informed decisions about their portfolios.

- Bill Management and Reminders: Users can set up bill reminders to ensure payments are made on time, avoiding late fees and maintaining a positive credit history.

- Tax Planning and Reporting: Quicken helps users keep track of tax-deductible expenses and provides reports that can be useful during tax season.

Features:

- Financial Reports: Quicken generates a variety of reports, such as income vs. expenses, net worth, investment performance, and more. These reports provide valuable insights into financial health.

- Automatic Transaction Downloads: Quicken can connect to bank and credit card accounts, automatically importing transactions for easy reconciliation.

- Loan and Debt Management: Quicken helps users keep track of loans, mortgages, and other debts, providing tools to create payoff plans.

- Mobile App Access: Quicken ‘s mobile app allows users to manage their finances on the go, providing access to key features and data.

- Data Security: Quicken typically employs strong security measures to protect users’ financial data, providing peace of mind.

Advantages:

- Time-Saving: Quicken automates many aspects of financial management, saving users time compared to manual tracking and calculations.

- Decision Support: The software provides the tools and information needed to make informed financial decisions, whether it’s investment choices or budget adjustments.

- User-Friendly Interface: Quicken is designed with an intuitive interface, making it accessible to users with varying levels of financial expertise.

- Goal-Oriented Planning: Users can set financial goals and track their progress, helping to stay motivated and accountable.

Experts of Quicken

- Quicken offers comprehensive financial management tools, allowing users to track and manage their expenses, budgeting, investments, and loans all in one place.

- It provides real-time syncing across multiple devices, enabling users to access their financial data anytime and anywhere.

- The software has a user-friendly interface with intuitive navigation that makes it easy for users to navigate and understand.

- Quicken offers helpful features like bill reminders and alerts to ensure timely payments and avoid late fees.

- It provides detailed reports and graphs that help users gain insights into their financial health.

Quicken Conclusion

In conclusion, Quicken stands as a versatile and powerful financial management tool, offering a wide array of features and benefits to users. From expense tracking and budgeting to investment management and tax planning, it provides a comprehensive platform for individuals and businesses alike to gain control over their finances.

With its user-friendly interface and customizable features, Quicken streamlines the process of managing income, expenses, loans, and investments. Its ability to generate insightful reports and offer goal-oriented planning tools further enhances its utility.